Thanks to their par values and steady coupon rates, bonds are often seen as the ‘safe’ asset class, particularly when compared to stocks. But lately, federally-backed bonds aren’t seeming too safe. The recent debt ceiling issues, credit downgrades, and rising deficits have many investors on edge. Treasury bonds might not be as safe as they seem.

But municipal bonds? It’s steady as she goes.

According to asset manager Northern Trust, munis’ credit quality is better than ever before. And that makes them a great buy, potentially over Treasury bonds. For investors, adding a dose of munis continues to be the right play.

A Big Downgrade

America’s finances aren’t exactly in the black. Thanks to rising expenditures, pandemic stimulus packages, and new bills designed to improve infrastructure, Congress has been writing some big checks. Coupled with that has been continued in-fighting in Congress. New worries about the debt ceiling have emerged.

At the same time, the rise in interest rates now means that the Fed needs to pay more interest on their debts to begin with. Short-term debt is paying close to 5%, while longer-term debt, such as 10- and 30-year bonds, have yields approaching records not seen in decades.

To that end, the United States got its second debt downgrade, this time coming from Fitch over the summer.

For fixed income investors, surging yields, downgrades, and congressional in-fighting throw them for a loop. Treasury and federally-backed debt are considered the gold standard. But these days, it may not be as ‘safe’ as it appears. To that end, those looking for the safety of bonds may need to look elsewhere.

Municipal Bonds to the Rescue

High-net-worth asset manager Northern Trust may have the answer to fixed income investors’ dilemma: municipal bonds. It turns out that, while the United States Treasury may be in a weakening state, state and local governments are facing the opposite situation. They are getting better in terms of credit quality and ability to pay their debts.

While all the pandemic stimulus may have been a weakening factor to the federal balance sheet, it’s been a big win for states. All that stimulus has helped job growth, home sales/values, and asset gains. Here, many states are now featuring some of the largest rainy-day funds in history.

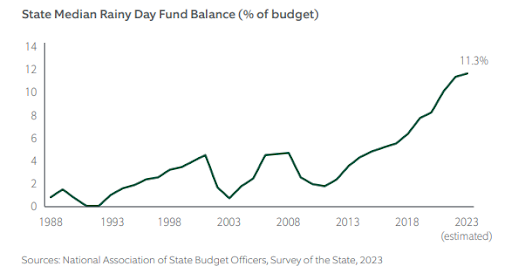

According to Northern Trust, total ‘Rainy Day Fund’ reserve balances grew from $77 billion in fiscal 2020 to $135 billion as fiscal 2022 closed. That pushed the median rainy day balance to 12% of state budgets heading into 2023 versus just 8% in 2020. Looking at historical data, Northern Trust shows that the median state had a cushion of less than 5% heading into the Great Financial Crisis of 2007-08.

This chart from the asset manager shows the surge in rainy day fund balances.

Source: Northern Trust

At the same time, states have been cautious about issuing new debt. Pension funding has also gotten a boost from the last few years’ worth of good asset returns and, ironically enough, the higher yields on federal debt.

What About Taxes?

One worry for many pundits in the municipal bond sector has continued to be the slippage of income and property tax receipts from many states. But according to Northern Trust, the damage isn’t as bad as many fear.

Yes, state tax revenue growth has slowed in fiscal 2023. According to the Urban Institute, for the nine months through March, total state revenues decreased by 2% compared to the prior year. However, states are coming off the two largest years of tax revenue since the National Association of State Budget Officers (NASBO) began collecting data in 1979, with increases of 17% in fiscal 2021 and 15% in fiscal 2022. After such historic surges, a decline is to be expected. Moreover, the decline for fiscal 2023 is still well above pre-pandemic levels.

As such, the vast majority of states fall within Northern Trust’s “strong”, “healthy”, and “moderate” designations. Only three states—Illinois (4th largest bond issuer), New Jersey (7th), and Connecticut (19th)—are considered “challenged.”

To that end, Northern Trust believes that states are generally well prepared for a mild-to-moderate recession. At the same time, their cash on hand and recent reductions to budgets (e.g., California’s latest budget is 5% less than last year) is a net positive when compared to Federal debt. Adding in their strong investment-grade credit ratings and munis’ tax advantages, the bonds make for a wonderful portfolio addition and potential Treasury replacement.

Municipal Bonds Remain a Buy

Given some of the woes facing Treasuries, muni debt makes a lot of sense as a complement or even a replacement for these bonds. With the major bond benchmark Bloomberg U.S. Aggregate Index holding no munis, it means investors need to do the digging themselves.

In Northern Trust’s missive, they recommend holding quality bonds and avoiding some of the more troubled states. In their high-net-worth client base, that could mean buying individual bonds. However, it’s still easier for us to buy munis via a broad series of ETFs.

The iShares National Muni Bond ETF remains the largest and easiest way to get exposure to the asset class. Featuring over $32 billion in assets and swift trading volume, the ETF is a quick way to add muni bonds. The Vanguard Tax-Exempt Bond Index Fund and SPDR Nuveen Bloomberg Municipal Bond ETF also provide low-cost ways to gain exposure.

To follow Northern Trust’s advice and avoid ‘troubled’ states, going active could be a great plan. Active management can add alpha to fixed income portfolios. And munis are no different. Northern Trust offers its own Tax-Exempt Bond, while PIMCO and JPMorgan offer PIMCO Intermediate Municipal Bond Active and JPMorgan Municipal ETF, respectively.

Passive & Active Municipal Bond ETFs & Mutual Funds

These funds were selected based on their YTD total return, which range from -1.9% to 2.5%. They have expenses between 0.05% to 0.50% and have assets under management between $45M to $35B. And they are yielding between 2.8% and 4%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| MEAR | BlackRock Short Maturity Municipal Bond ETF | $615M | 2.5% | 3.7% | 0.25% | MF | Yes |

| PVI | Invesco VRDO Tax-Free ETF | $45M | 2.1% | 3.4% | 0.25% | MF | No |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1B | -0.1% | 3.1% | 0.35% | ETF | Yes |

| JMUB | JPMorgan Municipal ETF | $725M | -0.5% | 3.7% | 0.18% | ETF | Yes |

| VTEB | Vanguard Tax-Exempt Bond Index Fund ETF | $30.4B | -0.3% | 2.9% | 0.05% | ETF | No |

| MUB | iShares National Muni Bond ETF | $34.3B | -0.7% | 2.9% | 0.07% | ETF | No |

| NOTEX | Northern Tax-Exempt Fund | $735M | -0.2% | 4% | 0.50% | MF | Yes |

| TFI | SPDR Nuveen Bloomberg Municipal Bond ETF | $3.24B | -1.9% | 2.8% | 0.23% | ETF | No |

Ultimately, states continue to show their strength when it comes to credit quality and ability to pay their bills. Given the current issues, Treasuries and other federal debt can’t say the same thing. With that, investors should consider adding more munis to their portfolio, even if that means reducing their holdings of Treasuries.

The Bottom Line

Treasury bonds are considered the ultimate safe haven. But lately, munis have been acting like the better bond position. Thanks to rising credit quality and big rainy-day funds, Northern Trust believes that municipal debt may be a better option for portfolios. Adding the bonds to a fixed income portfolio is very prudent in the current environment.