Municipal bonds have long been praised by investors for their ability to generate tax-free income. For those in higher tax brackets or those who fall under the high-net-worth category, the ability to minimize federal and state level taxes is a vital tool for portfolios. But as we know there is no such thing as a free lunch.

In the case with munis, we’re talking about the dreaded alternative minimum tax or AMT.

But for those who don’t need to worry about the AMT – which is the vast bulk of us – munis subjected to the alternative tax scheme can offer big yields and big discounts to the broader muni sector. And here, investors can win some hefty tax-free income.

What is The Alternative Minimum Tax?

There are a lot of loopholes and ways for people to pay less in taxes. And generally, the wealthier you are, the more opportunities you have to do so. In order to help make sure that wealthier taxpayers are paying their fair share, there is a secondary tax system called the alternative minimum tax (AMT). In a nutshell, the AMT removes a number of deductions that are allowed in the ordinary income tax code, which then causes some taxpayers to fall under the AMT’s guidelines and pay more in tax overall.

For municipal bonds, this poses an interesting problem. Most munis fall under general obligation (GOs) bonds or revenue-backed categories. These are bonds issued by state or local governments to fuel general spending or a project like a sewer system or toll bridge. However, there is a third category, dubbed private activity bonds. These are bonds issued to court businesses or to finance a special project that’s beneficial for the public good but won’t be owned by the municipality or state. These are things like football stadiums, airports, private hospitals, a shopping mall, etc.

The problem is that GOs and most revenue bonds are used in the AMT calculation. However, many PABs count under the AMT and investors must include the interest under the secondary tax system. For higher income earners, this can be a major issue and result in having to pay more tax.

The Opportunity for Investors

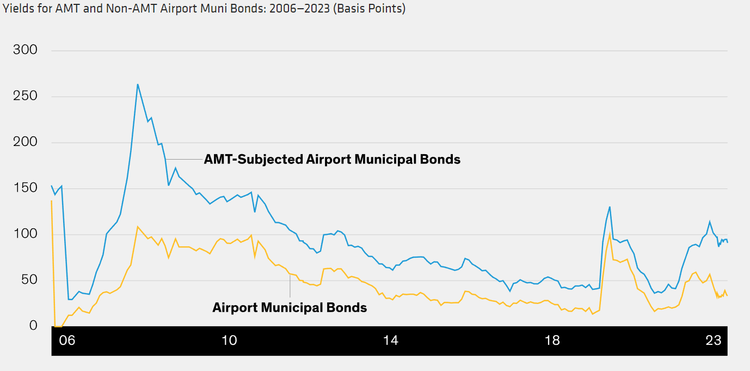

The vast bulk of muni buyers are these high-net-worth individuals and institutional investors. And as such, they don’t necessarily want to have any exposure to the AMT. After all, the tax can reduce yields by 28% or more. The result is that AMT munis often trade at discounts to the regular muni market. AMT bonds generally yield 30 basis points or more over their non-AMT equivalents.

This chart from AllianceBernstein looks at AMT and non-AMT airport municipal bonds. As you can see, since 2006, the AMT subject bonds have traded at higher yields, solely because of the tax potential for high-income investors. This is just one example, but the pattern is the same for the bulk of AMT bonds.

Source: AllianceBernstein

The kicker is that the majority of investors are not subjected to the AMT in any way. The Tax Cuts and Jobs Act of 2017 made that number even less, pushing income limits even higher than before. When the Act was passed, more than 5.2 million taxpayers were subjected to the AMT. According to IRS data, only 150,000 filers had to use the AMT after the bill. So, unless your last name is Rockefeller or Walton, there’s a good chance that you’ll never have to worry about the AMT.

This creates an interesting proposition in AMT bonds for many investors – there’s the ability to score a higher tax-free yield.

Getting Exposure

Given the discounts to regular muni bonds, investors may want to give their portfolios a shot of AMT bonds. However, there are a few caveats. One being that PABs generally aren’t rated as high as GOs or revenue-backed munis. Some can even be considered junk or high yield. As a result, these sorts of bonds shouldn’t comprise your entire muni allocation and should serve as a compliment to them.

The second caveat? Getting pure exposure. Because most historical muni buyers have been focused on not being subjected to the AMT, the majority of funds specifically look for AMT-free bonds as part of their mandate and fund titles. The same applies for major muni indexes.

Right now, there is no 100% AMT-focused muni fund of any kind. But there are plenty that include or have the bulk of their portfolios in these bonds. For indexers, this includes the SPDR Nuveen Bloomberg High Yield Municipal Bond ETF and the VanEck Short High Yield Muni ETF.

For investors looking for an AMT discount, active management could be the best opportunity. With managers being able to exploit discounts and buy higher yielding bonds that are subjected to the AMT, an actively managed fund is a great choice. The AB High Income Municipal Portfolio has about 13% of its holdings exposed to AMT bonds to give it a yield boost, while the Oppenheimer Rochester High Yield Muni A has about 42% of its portfolio in non-rated private activity bonds.

Finally, closed-end funds (CEFs) could be an interesting way to get exposure at a discount. Thanks to their tradability, they can often be had for less than their net asset values, allowing investors to buy $1 worth of assets for 80 or 90 cents. Many also offer exposure to AMT bonds. For example, the Nuveen Municipal Credit Income Fund has about 16% of its assets in AMTs and can currently be purchased at a 15% discount to its NAV.

Some Top Performing AMT-Holding Bond Funds

| Name | Ticker | Type | Active? | AUM | YTD Ret (%) | Expense |

|---|---|---|---|---|---|---|

| SPDR Nuveen Bloomberg High Yield Municipal Bond ETF | HYMB | ETF | No | $1.84 billion | 0.9% | 0.35% |

| Oppenheimer Rochester® High Yld Muni A | ORNAX | Mutual Fund | Yes | $8.01 billion | 0.7% | 0.95% |

| PIMCO High Yield Municipal Bond | PHMIX | Mutual Fund | Yes | $2.67 billion | 0.4% | 0.57% |

| Nuveen Municipal Credit Income Fund | NZF | CEF | Yes | $2.01 billion | 0.2% | 2.2% |

| AB High Income Municipal Portfolio | ABTHX | Mutual Fund | Yes | $3.48 billion | -0.2% | 0.85% |

| VanEck Short High Yield Muni ETF | SHYD | ETF | No | $421 million | -0.3% | 0.35% |

| BlackRock High Yield Muni Income Bond ETF | HYMU | ETF | Yes | $25 million | -4.4% | 0.53% |

The Bottom Line

For many investors, opportunities can exist within those munis subjected to the AMT. Thanks to the avoidance by many high-net-worth investors and institutions, these bonds trade at discounts, allowing investors willing to take on the risk at higher yields. As a portion of your fixed income sleeve, they can do wonders to boost your overall yield on a tax-free basis.